Table of Contents

Ways to reduce the risk of an investment in your portfolio

The asset allocation of your portfolio is not only dependent on some personal criteria like your financial goals, savings, risk tolerance, and age but is also dependent on cash, debt, and equity.

If you intend to get high returns on the equity of your investment portfolio you are investing on without considering risk management, you might be making the wrong investment moves.

As long as the investment is concerned, some risks are involved, and ignoring them will lead to a huge loss.

The Best Strategies To Protect Your Portfolio

Important Highlights:

- Adopt the principle of protecting your principal with adequate risk management.

- Diversifying assets

- Use the stop-loss orders to cut your losses on time before they get out of hand.

- Always have a safeguard plan for your investment capital

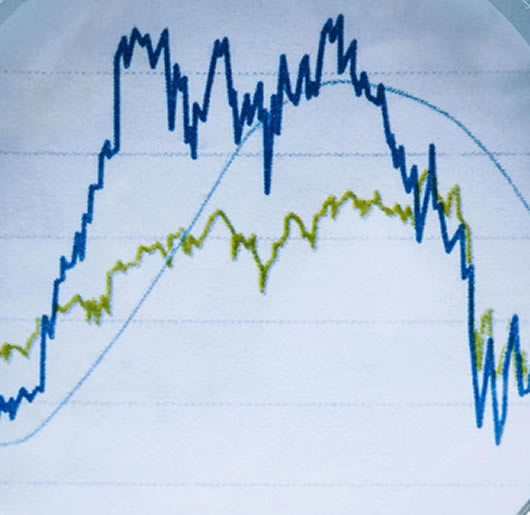

Reducing loss is a key principle to adhere to when you are investing and when a sign of the market heading downtrend, you shouldn’t be in haste to liquidate your investment holdings. At the same time, you should stay abreast of the market speculations to help you determine the losses you intend to incur.

The best measure to embrace for long-term successful investing, to grow your assets, is protecting your capital with adequate risk management. Of course, it is impossible to eliminate risk while investing but adopting the right strategies in protecting your portfolio should be put into good consideration.

However, these listed ways can go a long way in protecting your portfolio.

1. Implementing Stop Loss Orders

Falling market share prices can be eliminated with stop-loss orders. The stop-loss orders come in various forms that you can implement in your trades.

- The Trailing Stop: This move with the price of the stock which can be set to take profit and exit when the trade hits a price above your entry point.

- The Hard Stops: This triggers a sale order of a stock price when it falls below your trading price order.

Stop losses from using both hard and trailing stops ideally protect you from the market prices that change rapidly which in return will cut losses to a bare minimum. So always ensure well-planned out stops for any orders on market price entry.

2. Diversification of Assets

Modern portfolio theory stipulates emphasis on diversification of assets because a well-diversified portfolio will perform far better than the one which is concentrated.

Investors should adhere to creating several diversified portfolios in more than one asset class of their investments. This helps to reduce the risks of investing in just a particular company.

Also, several diversified stock portfolios with several stocks can help to eliminate or reduce the risks of an investment to a bare minimum.

3. Non-Correlating Asset Classes

Non-correlating asset classes have a different pattern of market movements as they move in inverse patterns compared to stocks. They help to mitigate the risks involved in the volatility of your portfolios when a particular asset is on one side of the trend in opposite direction to the other.

You can add non-correlating asset classes such as commodities, bonds, and currencies to the equities in your portfolio as a way to reduce un-planned risk.

However, implementing the non-correlating assets helps to provide more balanced returns in performance.

4. Put Options

When some stocks have a good winning uptrend, they usually would take a moment to relax before continuing higher. In this situation, you want to take in some of your gains and not be in haste to sell.

This is when you need to buy put options with the option to sell a stock at a particular price in the future when the price of the underlying stock goes down in price.

When the cost to buy the put option rises, you can sell the option for a profit to offset the losses in the price of the stock.

Ultimately, investors can buy long-term equity anticipation securities (LEAPS) for long-term assets protection. Also, buying index LEAPS can protect an entire portfolio other than just particular stocks.

5. Dividends

Dividends can make a yield on a part of an entire amount of a stock’s total return on your investment. So, Investing in stocks or owning a part of dividends paying stable companies that pay dividends can be a part of delivering above-average returns or protecting your portfolio.

Ultimately, dividends-paying companies grow their earnings quicker than others who don’t and this brings about higher capital gains and higher share prices.

So, when you increase your overall return, your portfolio will be protected as stock prices start falling. This also enables dividends to provide the relevant risk-aversion for investors leading to lower volatility.

Dividends can also act as a great hedge against inflation. When you invest in dividend-paying blue-chip companies with pricing power, your portfolio will be offered the kind of protection other forms of investments can’t provide.

Investing in companies that have increased their annual dividends for more than two decades, you can be rest assured that such companies will increase their annual payout even as that of bonds doesn’t change. This will help to cushion your purchasing power during the high inflation period as you approach your retirement.

Principal-Protected Notes

Principal-Protected Notes and Bonds have features income because of their nature of fixed-income securities where your investment principal is returned to you after maturity.

Nonetheless, what differentiates them is the existence of equity participation and the principal guarantee. However, investors might consider maintaining their principal with equity participation rights alongside principal-protected notes.

The Principal-Protected Notes usually will mature into the years of their investment. There would be no interest paid on the bonds until when the face value of the maturity is redeemed.

So, at maturity, the profits would be distributed when the bonds enter the maturity phase.

However, the principal-protected notes are a great investment option for risk-aversion investors. Before considering this option, you need to put other factors into consideration such as the investment notes, the fees involved in buying them, and the capacity of the financial institution to provide the guarantee for the principal.

FINAL NOTES!

The above list of strategies to protect your portfolios can go a long way to preserve your investment capital from market price volatility.

You should implement the one that is adequate for your risk tolerance and to help preserve your investment principal thereby putting your mind at rest.

We try as much as we can to provide relevant information for our users. As you toll the path to financial investment, note that there is a great risk involved in investing. So you should consider consulting with financial experts to help you choose a good investment option suitable for your risk tolerance.

READ ALSO: How to Reduce Risk in Your Investment Portfolio

Frequently Ask Questions (FAQ) On Reducing Portfolio Risk

What are the two types of portfolio risk?

The two types of portfolio risk are loss of principal risk, and purchasing power or inflation risk which is the risk involved when inflation is higher than expected and the delivery offers a lower rate of returns on the investment portfolio for investors.

What are the types of risk in portfolio management?

The types of risk in portfolio management:

- Liquidity risk

- Inflation risk

- Concentration risk

- Reinvestment risk

- Credit risk

- Longevity risk

- Horizon risk

- Market risk. This is the risk of an investment that is declining in value as a result of economic activities or crises that affect the market.

What type of portfolio is commonly used?

The type of portfolio that is commonly used:

- Income portfolio

- Conservative portfolio or capital preservation portfolio or defensive portfolio

- Socially responsible portfolio

- Aggressive portfolio. Also known as a capital appreciation portfolio.

What are the three purposes of a portfolio?

The purposes of a portfolio can be traced in a student portfolio from the academic compilation of work and other areas forms of educational activities gathered together for the sole purpose of:

- Analyzing the quality of coursework, academic accomplishment, and overall progress of learning.

- Estimating the learning standards of students and other activities of academic grade-level or courses.

What are the contents of a portfolio?

The contents of a portfolio can be narrowed down to several different categories for consideration to create a portfolio and they include:

- Personal Information

- Skills

- Education

- Training

- Goals and Values

- Recommendations

- Achievements and Job History

What are the benefits of a portfolio?

The benefits of a portfolio:

- The selection process for project improvement

- Concentrating on business objectives

- Collaboration

- Using resources more efficiently

- Accurate analysis of performing project data

- Enhance project deliveries period

- Reducing business risk

You can leave a comment below on your opinion of what you think on The Strategic Ways To Reduce Portfolio Risk When Investing.

Share